GST Registered

100% Trusted

24/7 Support

ISO Certified

Want to claim a packers and movers bill?

We provide 100% original and GST-approved movers and packers bill for claim at affordable rates with a 100% Money-Back Guarantee.

Packers and Movers Bill for Claim – Everything You Need to Know

When relocating for personal or professional reasons, having a Packers and Movers bill for claim is essential for those seeking reimbursement from employers or filing insurance claims. This bill serves as valid proof of the relocation expenses incurred and must be detailed and GST-compliant to be accepted by HR departments or insurance providers.

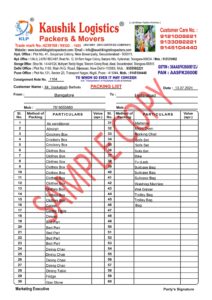

A proper bill for claim includes key details such as the service provider’s name, GST number, address, invoice number, date of service, and contact details. It should also itemize all the services offered—packing, loading, transportation, unloading, and any additional services like warehousing or transit insurance. The bill must be signed and stamped by the company to validate its authenticity.

To avoid delays in processing your claim, always inform the moving company in advance that you require a bill specifically for claim purposes. Choose a reputed and GST-registered Packers and Movers company to ensure compliance and reliability. Retaining both soft and hard copies of the invoice is advisable for future reference.

A transparent and well-structured Packers and Movers bill helps streamline the reimbursement or insurance process, giving you peace of mind during your move. Always verify all entries in the invoice to avoid any issues later.

Request A Quote

Why Choose Us

Legitimate Process

Tread a 100% legal path to claim your Relocations Bills and invoicing.

Verified Bill

Avail authentic and admissible packers and movers Bill with GST No.

Hard Copy of Bill

Gets a hard copy of the packers and movers bill to claim reimbursement from your company

Easy Process

Choose an easy process to generate an original shifting receipt to save your time and energy

Lost Your Shifting Receipt?:

Have you lost your relocation bill and are now struggling to get an allowance from your employer? If so, you don’t need to fret. Kaushik Logistics Packers & Movers is a renowned delhi based relocation company. We provide a 100% legal shifting or relocation bill for claim. So, as an experienced player in this field, we are in position to guide you in this situation. A correct guidance is imperative in such a situation. Without it, people often opt wrong ways to claim the allowance from their employer. Most often, presenting forged bills and lying through their teeth about its authenticity.

Employing this sort of way is not only pernicious to your credibility but it also can get you into trouble. Thus, it is advisable to tread a legal path to get your allowance. Go to a legally-registered company like Kaushik Logistics Packers & Movers to get an authentic invoice. They will trump all your difficulties faced by you due to lack of packers and movers original GST bill. There are countless companies who claim to offer genuine packers and movers bill for claim. Conversely, very few of them deliver on their promise. So, to avoid being deceived by any fraudulent company, you can contact us to get a shifting receipt.

Document Required to claim packers and movers Bill -

In order to claim your bill, certain documents are required, particularly when hiring packers and movers. The following documents need to be gathered:

Consignment Copy: This document is given to the consignee at the destination. It is duplicated four times: one copy is for the consignee, one for the consignor, one for the driver, and one for the office. It contains critical information such as the name, address, phone number, consignment number, terms and conditions, and item number. Sometimes referred to as ‘Bulty’, this is the primary document required for transportation.

Item List: This document is crucial when claiming your bill from your office as it determines the bill’s value. It’s not just important for insurance purposes but also helps you to inspect or tally the items when the packers and movers company unloads your belongings at the new location.

GST on the Bill Print: This is a paramount document when filing a claim. It separately lists elements like packing charges, transportation charges, loading and unloading fees, rearrangement costs, taxes, and insurance. It’s vital to verify the GST number on this bill.

Receipt of Funds: You obtain this document when you make a payment in cash. It is then sent to the moving and packing company. This receipt serves as proof of your payment.

How to recognise a forged GST Invoice?

GST (Goods and Services Tax) invoices can be tampered with or forged, making it challenging to discern whether they are authentic or not. In some instances, a trader might issue a GST invoice without a GSTIN (Goods and Services Tax Identification Number), which would be deemed fraudulent since the GSTIN is a prerequisite for any legitimate GST invoice.

There are several red flags that can help you identify a counterfeit GST invoice:

False GSTIN Usage: If a company that is not registered for GST creates a fictitious GSTIN on the invoice and imposes a GST, this is a clear sign of a fake invoice. The tax paid in this scenario would not be remitted to the government, as the GSTIN is not valid.

GSTIN Structure: Each taxpayer is given a unique 15-digit GSTIN, derived from their PAN (Permanent Account Number). Any deviation from this structure is a warning of a potential fake GSTIN. However, it’s important to note that even if a GSTIN is correctly structured, it doesn’t necessarily mean it is authentic or belongs to the company stated on the invoice.

Craving Details? Unearth the Packers and Movers GST Bill Format

Unravel the mysteries, as some movers charge GST without a GST number or insight. With GST reform landing in India on July 1, 2017, the landscape shifted. We delve into how this affects both the packers and movers and the customers’ wallets.

GST, the Goods and Services Tax, emerged on July 1, 2017, with its five-tier structure:

0% – A Glimpse at Packers and Movers GST Bill

The Reverse Charge Mechanism takes center stage. The recipient pledges direct GST payment to the Indian government. If you’re all about transport services, a flat 0% GST charge awaits, given you sport a GST number.

5% – Peering into Packers and Movers GST Bill

Picture this: disassembly, packaging, loading, transportation, unloading – a symphony of services. A mere transport journey dances at 5% GST. But when services don multiple hats, like packaging and labor, the curtains rise on 18% GST.

12% – Unveiling Packers and Movers GST Bill

At 12%, we encounter the transportation solo. However, tossing in dismantling, packaging, or loading/unloading for house shifting ignites 18% GST across the stage.

18% – Decoding Packers and Movers GST Bill

A grand ensemble demands the 18% spotlight. From disassembly to insurance, the whole package graces the scene, pleasing both you and the Indian government.

28% – Ruling out Packers and Movers GST Bill

The realm of luxury – gold, silver, and high-end couture – resides under the 28% banner. But for packers and movers, 28% is off-limits, enshrined in GST law.

IBA-approved entities, your guiding lights, ensure harmony with Indian government norms. Protection and insurance claims hold hands here.

F.A.Q

What is a packers and movers bill?

A packers and movers bill is an invoice issued by the moving company detailing the services provided and total charges for relocation. It acts as proof for reimbursement claims.

What details are mentioned in a standard packers and movers bill?

Customer details, address, item list, quantity, services, insurance, GST, and payment info are included in a standard bill.

Is GST applicable on packers and movers services?

Yes, GST at 18% is applicable on most services offered by packers and movers such as packing, loading, transportation, and unloading.

What documents are required to claim packers and movers bill reimbursement?

The documents required include the original invoice, goods receipt/consignment note, quotation copy, payment receipt, and any other document required as per your company’s reimbursement policy.

Can the bill format be customized as per company requirements?

Yes, the bill format can usually be customized to include all necessary details as required by your employer for claim processing.

Is insurance of goods mandatory for claiming reimbursement?

Insurance is not mandatory but highly recommended. Insured goods provide added protection and simplify claims in case of any damage during relocation.

How to verify if the packers and movers bill is authentic?

Key elements to check: valid GST number, company name and contact details, invoice number, signature, and company stamp on the original bill.

What is the time limit to claim packers and movers bill reimbursement?

The time limit is typically 3 to 6 months from the relocation date, depending on your company’s policy. Check with your HR for the exact deadline.